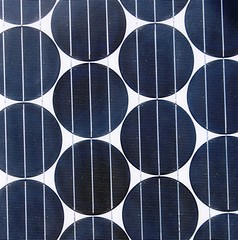

photo credit: Wichita Renewable Energy Group

Tax credits on earth friendly home improvements have been extended!

According to the National Association of Home Builders (NAHB), federal energy efficiency tax credits allow home owners to make wise ecological improvements and save money. The American Recovery and Reinvestment Act of 2009 was extended beyond 2009, permitting federal tax credits of almost 30% for Chicago residents who are willing to enhance the energy efficiency of their homes.

Water heaters, windows (including storm windows and doors), heating and air conditioning units, biomass stoves, certain insulation and roofing materials all are repairs falling under the 25C tax credit. This credit is due to expire in December, 2010. Typically these credits are only beneficial if your home is your primary existing residence, and rental properties do not qualify.

Solar panels, wind power, and geothermal heat pump systems fall under the 25D tax credit. This credit will not expire until December 2016 and second homes and new homes do qualify, although rentals do not. Check with your tax advisor for specific details on your project. For a full list of energy-efficient rebates available to Illinois residents, click here.